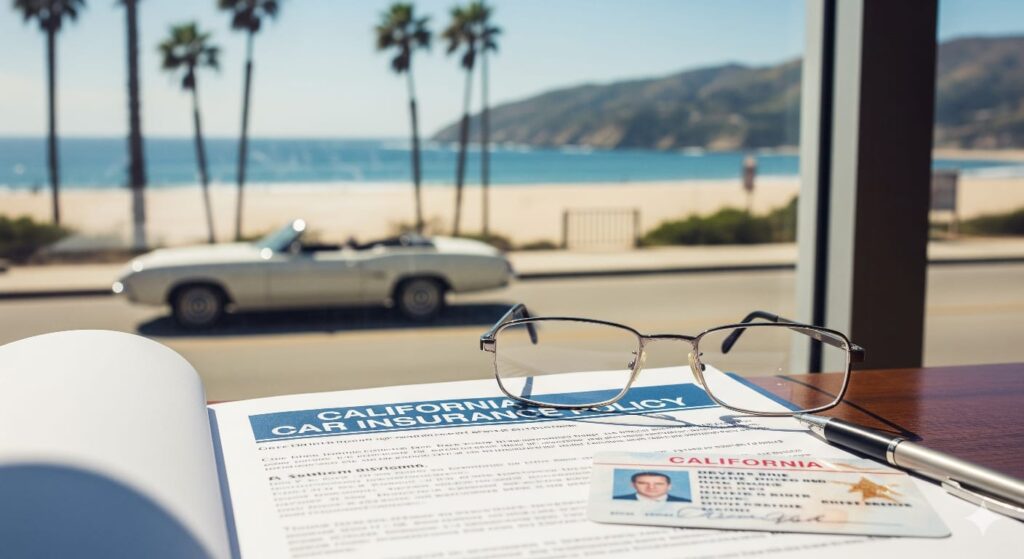

If you own a car in California, having auto insurance isn’t just a smart move—it’s a legal requirement. As the most populous and car-centric state in the U.S., California sees millions of vehicles on the road daily. From navigating LA traffic to driving up the Pacific Coast Highway, accidents can happen anytime.

Here’s your complete guide to car insurance in California in 2025, including types of coverage, average costs, and tips to find the best plan for your needs.

📜 Is Car Insurance Mandatory in California?

Yes. California state law requires all drivers to carry minimum liability insurance. This coverage helps pay for injury or property damage you cause to others in an accident.

🚦 Minimum Required Liability Coverage in California:

-

$15,000 for injury/death to one person

-

$30,000 for injury/death to more than one person

-

$5,000 for property damage

⚠️ Driving without insurance can result in fines, license suspension, and vehicle impoundment.

🧾 Types of Car Insurance Coverage in California

While liability is the legal minimum, it’s often not enough to fully protect you. Here are common additional coverage types Californians choose:

✅ Collision Coverage

Pays to repair your vehicle after an accident, regardless of fault.

✅ Comprehensive Coverage

Covers damage from theft, fire, vandalism, falling objects, or natural disasters (wildfires, floods).

✅ Uninsured/Underinsured Motorist

Protects you if you’re hit by a driver with little or no insurance—surprisingly common in California.

✅ Medical Payments (MedPay)

Helps pay medical bills for you and your passengers, regardless of fault.

✅ Roadside Assistance & Rental Reimbursement

Optional, but useful for breakdowns and temporary transportation.

💰 How Much Does Car Insurance Cost in California?

🔍 Average Monthly Premiums (2025):

| Coverage Type | Monthly Cost Estimate |

|---|---|

| Minimum Liability Only | $55–$85/month |

| Full Coverage | $130–$220/month |

📊 Cost Factors Include:

-

Age and driving history

-

Location (LA, SF, San Diego = higher rates)

-

Type and value of vehicle

-

Credit score and claim history

-

Coverage limits and deductibles

🌆 Regional Insurance Considerations

🚗 Los Angeles & San Francisco:

High traffic density and theft rates often mean higher premiums. Consider full coverage if parking in public areas.

🚗 Rural Areas (e.g., Central Valley, Sierra Foothills):

Lower rates, but you might want comprehensive coverage due to wildfire risks.

🏆 Top Car Insurance Providers in California (2025)

Here are some well-rated companies operating in California:

-

GEICO – Known for low rates and online convenience

-

State Farm – Strong agent network and bundling discounts

-

Progressive – Competitive pricing and accident forgiveness

-

Allstate – High customer satisfaction and customizable plans

-

Wawanesa – California-based, affordable for safe drivers

-

AAA of Southern California – Great for members, with perks

📝 Tip: Use comparison tools or a local broker to get personalized quotes from multiple insurers.

💡 Tips to Save on Car Insurance in California

-

🚗 Bundle with home or renters insurance

-

🧍♂️ Maintain a clean driving record

-

🎓 Ask for student, military, or senior discounts

-

💳 Improve your credit score

-

🚘 Choose a vehicle with safety and anti-theft features

-

📱 Use telematics or usage-based insurance programs

🛠️ What to Do After an Accident in California

-

Check for injuries and call 911 if needed

-

Exchange information with the other driver(s)

-

Take photos of the scene and vehicle damage

-

File a police report (especially if injuries or major damage occurred)

-

Notify your insurance company promptly

✅ Final Thoughts

Car insurance in California is more than a legal requirement—it’s essential financial protection in a state known for traffic congestion, expensive repairs, and natural risks like earthquakes and wildfires.

Choose a policy that fits your needs, your budget, and your lifestyle. Whether you drive through the city, coast, or countryside, having the right coverage gives you peace of mind on every mile of your journey.

Frequently Asked Questions (FAQs)

A: Yes. California law requires all drivers to carry minimum liability insurance of $15,000 for injury to one person, $30,000 for multiple injuries, and $5,000 for property damage.

A: In 2025, the average monthly premium ranges between $55–$85 for minimum liability and $130–$220 for full coverage, depending on your location, driving record, and vehicle.

A: Only temporarily. If you become a resident or register your vehicle in California, you’re required to switch to a California-compliant auto insurance policy.

A: No, it’s optional but strongly recommended. Around 15% of California drivers are uninsured.

A: Yes. A speeding ticket can raise your premium by 15–30% or more, depending on severity and insurer policies.

A: Absolutely. Many insurers offer discounts for good driving records, low annual mileage, student grades, anti-theft devices, and bundling policies.

A: Standard car insurance may cover wildfire damage under comprehensive coverage, but earthquakes are typically not covered unless specifically included (rare).